stocks

Everyone is Talking About Liquidmetal Technologies Inc (OTCBB:LQMT)

Published

9 years agoon

Liquidmetal Technologies Inc (OTCBB:LQMT) jumped last week after they announced they recently delivered their first production parts made in its Rancho Santa Margarita manufacturing facility, an innovative knife that exploits the benefits of Liquidmetal for the California based Miltner Adams Company.

The Hybrid Knife which debuted this past week at the 2015 BLADE Show in Atlanta, Georgia, combines the advantages of a fixed blade and a folder in one knife. The knife is the first of its kind in the world and is based on a Miltner Adams prototype. The Liquidmetal and Miltner Adams teams co-developed design refinements only possible with Liquidmetal.

Liquidmetal is a materials technology Company that has one of the most exciting and potentially disruptive technologies to come out in years. Their patented Liquidmetal family of alloys consists of a variety of proprietary bulk alloys and composites that utilize the advantages offered by amorphous alloy technology.

Liquidmetal Technologies Inc (OTCBB:LQMT) used to be a $20 big board stock with a billion dollar market valuation. Unfortunately the product was not yet ready for market and after a string of bad management decisions the stock ended up on the bb’s. LQMT started as a Caltech research project in the early 90’s that was eventually IPO’d on the NASDAQ in 2002.

Liquidmetal alloys contain atoms of significantly different sizes that form a dense mix. It behaves more like glass in the sense that its viscosity drops gradually with increased temperature and retains its form and amorphous properties even after being heat-formed.

Liquidmetal alloys combine a number of desirable material features, including high tensile strength, excellent corrosion resistance, very high coefficient of restitution and excellent anti-wearing characteristics. These unique properties means liquidmetal can be injection-molded into extraordinary precise shapes similar to a plastic, while overcoming the crystalline weakness and necessary machining inherent in other metals.

Liquidmetal has significant potential in a number of industries including aerospace, military, auto, watches, and cutlery to name a few. LQMT controls the intellectual property rights with more than 63 U.S. patents.

To Find out the inside Scoop on LQMT Subscribe to Microcapdaily.com Right Now by entering your Email in the box below

In 2010 LQMT entered into a license transaction with Apple Inc. pursuant to which, for a one-time licensing fee of $20 million, they granted to Apple a perpetual, worldwide, fully-paid, exclusive license to commercialize all of the company’s intellectual property in the field of consumer electronic products.

The Apple transaction obviously marked a huge milestone for LQMT which used the proceeds to pay off some of their outstanding debt. It was this news that was the catalyst for the run to $1.75.

Last month we quoted WATTS in the article which brought a healthy amount of criticism. According to WATTS??? ”If you’re going to cite “watts” as your source of authority on ANYTHING related to investments, let alone Liquidmetal, you might as well be speaking to his alter ego because “watts” is the same one who fervently applauded the Visser Precision Cast deal at its inception along with his original investment with people who were convicted of securities fraud, only to have their convictions overturned on a technicality. I don’t condone current mgmt, but LQMT had their backs against the wall and were, for all intents and purposes – DONE!

But their feet were put to the fire on the Apple deal. They had NOTHING to offer Apple at that point. They could have signed a deal with Schmucko enterprises for 20 mill. Would that have been a better deal? And if “watts” had a clue on due diligence, he would have investigated the facts of that deal instead of thinking Apple finally meant nirvana. Interestingly enough, that deal was initiated and also signed off on by the old management who committed fraud and who “watts” thought was more credible.

Management “failed to anticipate the number of years?” Is that a joke? It’s a disruptive tech. The old method was a MISERABLE FAILURE. The company burned through a hundred mill – minimum – of initial shareholder money on the IPO and much of it on their own self-interests to the extend they could not keep an auditor in place! They have actually accomplished more – and validated and cultured alliances – with companies that they had merely – at most – initiated prior. Does “watts” really think Materion and Engel would have continued their relationship with old management? “Watts” needs to give it a break.

As for “losing” old scientists – they have cultivated MORE through CIP, which is a joint venture IP entity owned 100% by Liquidmetal. But I’m sure “watts” thinks the Apple scientists like Steve Zadesky are a joke. Yeah, tell that to Tim Cook as Cook made Zadesky (a former Ford engineer and the principal engineer on the iphone project from inception) in charge of Apple’s auto initiative.”

LQMT UNKNOWN said ’’Paul, your “source” is off-base and has as much knowledge of what is going on in this company as someone who extols all of the benefits and none of the negatives. Your source cheered the benefits of that Visser Precision deal before ripping it, and management, when it crashed. As anyone knows, a disruptive tech is a very hard sell, but previous management were about as untrustworthy as you can get, but many (not all) only saw dollar signs instead of investigating their negative history and greed prevailed. And add on top of all that, attacks on a management team exercising heavy control of ownership and all an “investor” is doing is crushing their own investment. There is so much off-base with that source, it’s sad.

According to the 10Q LQMT filed on November 12 they maintain an enviable looking balance sheet for the bb’s showing a really strong cash position of $11.9 million in the treasury and minimal short term debt except for the $4.9 million in long term warrant liabilities. LQMT reported $97,000 in revenues for the quarter ended September 30 compared to $456,000 for the same period last year.

We have a Monster Pick Coming. Subscribe Right Now!

Currently trading at a $58 million market valuation LQMT does have $6.2 million in the treasury and little debt. The stock does command strong interest from Investors who site the fact that Apple is still very much vested in the Company and evidence suggests they will be using the technology in the near future; if this happens, LQMT could see worldwide exposure and send the stock into another stratosphere. We will be updating on LQMT when more details emerge so make sure you are subscribed to Microcapdaily so you know what’s going on with LQMT.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: we hold no position in LQMT either long or short and we have not been compensated for this article.

You may like

-

BMGs Boost Liquidmetal Technologies Inc (OTCBB:LQMT)

-

These are Exciting Times for Liquidmetal Technologies Inc (OTCBB:LQMT)

-

The Fast Appreciation on Liquidmetal Technologies Inc (OTCBB:LQMT)

-

The Steady Moves on Liquidmetal Technologies Inc (OTCBB:LQMT)

-

The Exciting Rise of Liquidmetal Technologies Inc (OTCBB:LQMT)

-

Potential New Uses Spark Liquidmetal Technologies Inc (OTCBB:LQMT)

2 Comments

Leave a Reply

Cancel reply

Leave a Reply

Featured

Clean Vision Corp (OTC: CLNV): Overcoming the Plastic Waste Crisis

Published

3 months agoon

January 18, 2024

Clean Vision Corporation (OTC: CLNV) has experienced several interesting developments recently, but it hasn’t noticeably influenced the market with any substantial gains. Nonetheless, we believe it’s worth providing an update on the company given it’s been a few months since our last mention. In today’s discussion, we’ll explore a variety of updates and their significance, with aim of providing insight on what to expect for 2024.

Background:

Clean Vision is led by Dan Bates, and their goal is to tackle the global plastic waste crisis head-on. Their wholly owned subsidiary, Clean Seas, has developed the Plastic Conversion Network (PCN), a groundbreaking technology aimed at diverting millions of tons of waste plastic from landfills, incineration, and oceans. The PCN converts this plastic feedstock into clean fuels and green hydrogen, significantly reducing reliance on fossil fuels and lowering the carbon footprint.

For a brief 2 minute overview on the company, feel free to reference the video CLNV’s subsidiary put together on YouTube. Here’s the link.

Clean Seas utilizes proven pyrolysis technology to produce environmentally friendly products, which are sold to multinational petrochemical companies, driving the circular plastic economy. Operational PCN facilities are already in place in Morocco and India, with additional conversion facilities in development across West Virginia, Arizona, and Southeast Asia. Long-term feedstock supply agreements exceeding one million tons of waste plastic annually have been secured at no cost.

Their recently trademarked brand, AquaH®, is produced in their PCN. According to the release, it offers a differentiated green hydrogen product from carbon-neutral sources. Currently, hydrogen is predominantly produced through methods that involve fossil fuels, which of course contributes to global carbon emissions. Furthermore according to Deloitte’s 2023 global green hydrogen outlook, this could be a $1.4T annual market by 2050.

$65 Million Plastic Conversion Facility:

CLNV is making big moves in West Virginia and according to the release on October 24th, 2023, they’ve brought in some serious players—CDI Engineering Solutions and ERM—to help out with their Clean-Seas West Virginia project.

CDI has over 70 years of experience integrating engineering, design, project support, procurement and construction management services to the energy, chemicals and electrical infrastructure markets.

ERM is the world’s largest advisory firm focused solely on sustainability, offering environmental, health, safety, risk and social expertise for more than 50 years with more than 8,500 dedicated professionals operating across 40 countries.

The plan is to kick things off in 2024, turning 100 tons of plastic every day into recycled plastics and clean fuels. It’s a hefty project with a $65 million investment, creating over 200 jobs initially. And they’re not stopping there—they want to scale up to 500 tons of plastic per day over time.

West Virginia Governor Jim Justice is also on board, throwing over $12 million in state incentives to support the project.

Governor Jim Justice made a reference to Clean Seas in his state of the union address. If you want to catch the mention, go to 34:15 in the video. The three minutes leading up to it are also worth reviewing.

Subscribe to Microcapdaily.com Right Now by entering your Email in the box below.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Launches Global Operations:

CLNV made another significant advancement, planning to launch waste plastic conversion facilities in the European Union, Eastern Europe, and Southeast Asia. This will be accomplished through their new subsidiary, Clean-Seas Partners UK Limited (CS-UK), who of course shares the same vision of creating sustainable solutions to the global plastic pollution crisis.

Under the leadership of Managing Director Shaun Wootton, CS-UK will play a crucial role in strategic project development and investment facilitation, leveraging established relationships in the Middle East, Southeast Asia, and Europe.

To fortify effective governance and strategic direction, CS-UK is assembling a distinguished board with internationally recognized figures in banking, sustainability, and energy. This approach aims to have a diverse and experienced board guiding CS-UK in realizing its vision of promoting sustainability and environmental stewardship across diverse regions.

$340 Million Bond Offering:

CLNV even announced they partnered with a global advisory firm, Grant Thornton, to issue up to $340 million in Green Bonds. This is the world’s sixth-largest network of independent accounting and consulting firms, employing 62,000 people in more than 130 countries and had revenues of $6.6 billion in 2021. These bonds will fund the expansion of Clean Vision’s Plastic Conversion Network (PCN) under the “Clean-Seas” initiative worldwide, aimed at combatting plastic pollution on a global scale.

With the Green Bond’s net proceeds, CLNV plans to deploy at least six plastic waste conversion lines globally, with strategic locations in West Virginia, Arizona, Southeast Asia, and expansion in Morocco. The Green Bond is also expected to attract environmentally conscious investors, setting a new standard for corporate responsibility.

$15M Government Loan:

Lastly, under the capable management of Huntington Bank, CLNV has recently secured a $15 million government loan. What sets this apart is that the loan is FORGIVABLE.

A forgivable loan is a type of loan where the borrower is not required to repay the borrowed amount under certain conditions. Typically, these conditions are related to the borrower meeting specific criteria, such as using the funds for approved purposes, maintaining certain employment levels, or achieving predetermined goals. If the borrower fulfills these conditions, the loan is forgiven, and they are not obligated to repay the borrowed amount. Forgivable loans are often used as an incentive or support for specific activities, such as job creation, small business development, or other initiatives that contribute to economic growth or community welfare.

Not to mention it won’t result in any dilution for shareholders. This is an unexpected and uncommon accomplishment for an OTC company. Securing a government loan of this size without any dilution is truly impressive.

Conclusion:

CLNV has made impressive strides tackling the global plastic waste crisis, especially given their valuation of merely $22.65 million. The team has swiftly achieved key objectives, including a $65 million plastic conversion facility in West Virginia, global expansion through Clean-Seas Partners UK Limited, a $340 million Green Bond Offering, and a remarkable $15 million forgivable government loan. The vast $1.4 trillion market they’re tapping into offers an interesting opportunity with current indicators looking positive. Nevertheless, it’s crucial to acknowledge that there is still significant work ahead, and the team needs to maintain consistent execution to turn this potential into a reality.

We will update you on CLNV when more details emerge, subscribe to Microcapdaily to follow along!

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: We have not been compensated for this article/video. MicroCap Daily is not an investment advisor; this article/video does not provide investment advice. Always do your research, make your own investment decisions, or consult with your nearest financial advisor. This article/video is not a solicitation or recommendation to buy, sell, or hold securities. This article/video is our opinion, is meant for informational and educational purposes only, and does not provide investment advice. Past performance is not indicative of future performance.

Picture by pasja1000 from Pixabay

BioPharma

Bioxytran (OTCMKTS: BIXT) Peer-Review Published Showing Functional Cure for COVID-19

Published

1 year agoon

March 28, 2023By

Chris Meeks

On the cusp of a cure for COVID, one of the most promising yet under-the-radar biotech stocks on the OTC is generating much well-deserved buzz in the scientific community and is poised to go viral.

Bioxytran Inc. (OTCMKTS: BIXT) over the weekend had their phase 2 top-line results published in the peer-reviewed journal “Vaccines.” There is a not-so-subtle tinge of irony in that name because while their drug is nothing like a vaccine, there is no doubt about its efficacy– 100% PCR negative rate by day 7 versus 6% in placebo. The medical journal article was titled “An Oral Galectin Inhibitor in COVID-19 – A Phase 2 Randomized Controlled Trial.” This is a landmark journal article because – until now – only one other drug, Harvoni, had equaled a 100% responders rate in the past decade. Harvoni ultimately ended up being a cure for Hepatitis C Virus.

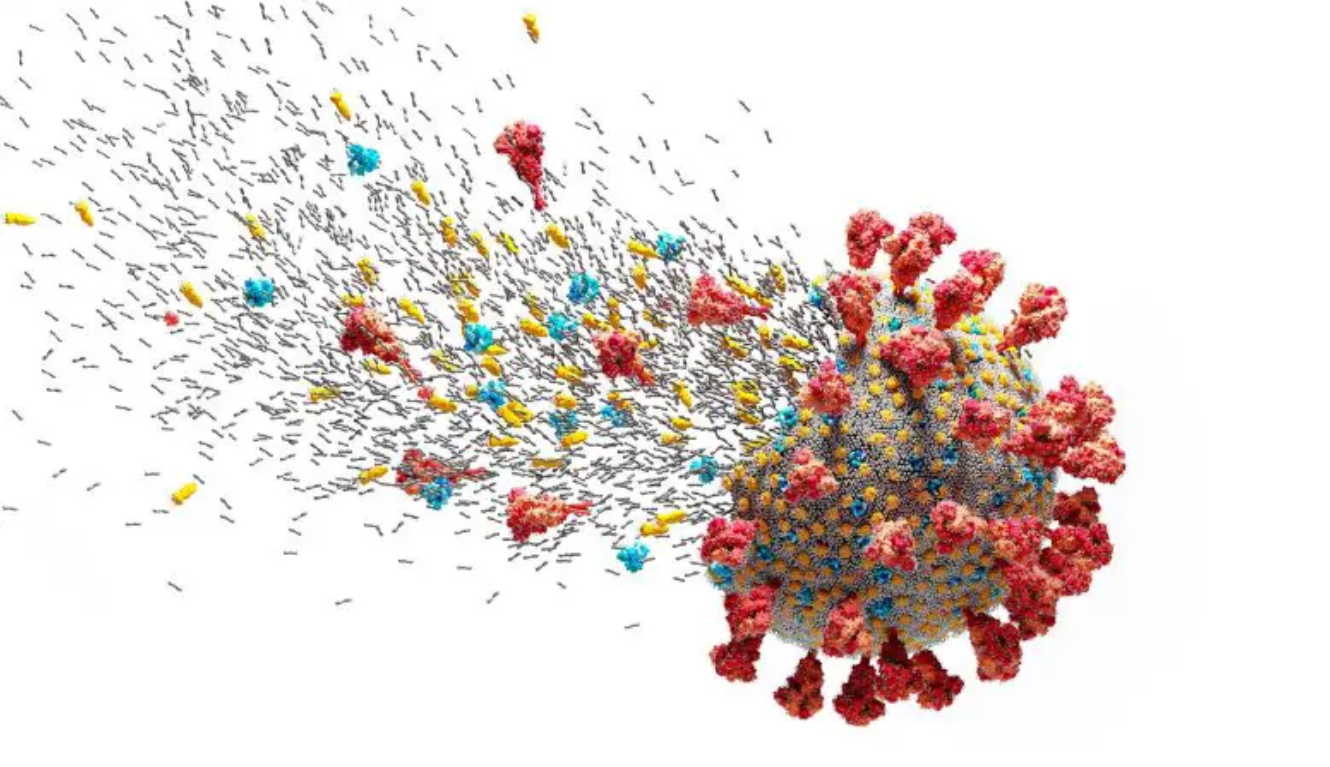

At this point in Bioxytran’s drug development pipeline, it essentially has a functional cure for COVID-19 that simply needs a pivotal phase 3 trial to show the true extent of their discovery. Their drug is a galectin antagonist, which neutralizes the now infamous spike proteins by placing a carbohydrate sheath over the spikes making attachment to the cell impossible. The carbohydrates binding grip is so tight on the virus that it carries it around in the blood until it is eventually filtered out by the liver and excreted.

If solving the pandemic wasn’t enough, the company recently reported that in vitro studies suggest the drug would be effective in Influenza and RSV. Yet despite the fact that this one drug could seemingly end upper respiratory infections, which most of us refer to as a “common cold,” it has a nominal market cap of just $50 million.

For the past three months, BIXT has been teasing this peer-reviewed article as a catalyst and a major value inflection point for the company. Despite that, investors haven’t gotten the hint, and have been steadily selling into this inflection point. Even though the company has yet to report it in a press release, the scientific community is understandably going crazy over it. Investors, however, are seemingly oblivious to the viral traffic and simply not paying attention to the sheer magnitude of the discovery–a functional cure for COVID and the methodology to seemingly combat any virus.

One of the reasons peer review is so important for a biotech is that major media outlets won’t touch the science without it. With its publication, this article means that BIXT now has an opportunity to tell its story on network media. The biggest risk that investors now face in BIXT is FOMO, driven by an unexpected media appearance that ushers unbridled buying into the name and leaves tepid investors chasing up.

If the article itself wasn’t enough, their peer-reviewed article was picked up by a major biotech influencer on Twitter, quickly garnering more than 100k hits. The influencer, Chris Turnbull, summarized the article highlighting key points like the rapid viral clearance in 3 days through entry inhibition and suggested the ideal use is when you know you were exposed. He hammered the point that ProLectin-M was for standard-risk patients and that Paxlovid was for high-risk groups with at least one medical condition.

This discovery changes the COVID landscape permanently. Multi-billion dollar antiviral drugs like Paxlovid and Lagevrio can’t hold a candle to the viral clearing power of BIXT’s galectin antagonist. Looking at the Twitter account of BIXT Chief Commercial Officer Michael Sheikh, it’s clear that there are some ongoing discussions with big pharma that have not yielded any fruit. But big pharma may not be their only option. BIXT has also said they are looking to partner with companies with large cash balance sheets. Both galectin antagonist companies Galectin Therapeutics (NASDAQ: GALT) and Galecto Bioscience (NASDAQ: GLTO) fit the profile and are the subject of a number of relatively supportive tweets by Sheikh. Sleuthing Sheikh’s LinkedIn profile reveals hardcore evidence of that sort of dealmaking with clusters of top executives in certain companies and networking, which suggests significant activity among their larger Galectin-focused peers. In an emerging growth interview, the CCO did say that he got a lot of business cards and was networking.

There exists a huge chasm between the current market cap and what it ought to be given that it successfully completed a phase 2 and nailed the endpoint with a perfect score. The CCO described in an Emerging Growth video how valuations work and a number of comparables in the $500 million range for a number of disease indications that BIXT is developing. The stock has a very tiny float of 19 million with an OS of 123 million. This represents a float of 15% and insiders own over 60%. There is no dilution from the convertible notes as they have company-friendly terms that allow up to 5% conversion into restricted common stock. In an Emerging Growth interview a couple of months ago, the CCO acknowledged the stock’s current challenge, indicating a legacy seller was responsible for half the daily volume and was almost gone. In early March after a ZeroHedge article was published, the stock went on a record run to $1.05 in a matter of minutes before short forces brought it back down. On March 7th it looks like the seller ran out of inventory for the day and the demand just lifted the stock price allowing it to go through a short period of natural price discovery. The long-term legacy seller seems to be at the end of his block, which means any news announcement could push the stock higher.

Low-Risk Explosive Reward Profile

There is no doubt that BIXT has incredible potential yet the stock continues to languish. With the anemic volume, it’s very difficult to diagnose what the root cause is for the disconnect from the comparable valuations established by big pharma in the $500 million region and BIXT’s current $50M cap. If one article that generated a little bit of buying pushed it to the brink of explosiveness, perhaps there is more stock from this legacy seller that is still controlling the narrative.

Upcoming Catalysts

For the investor with a longer-term view, BIXT represents a safe place to park funds for explosive returns. The upcoming catalysts are a dosing of patients in India for the dose optimization trial, a potential IND from the FDA, and of course, the announcement of the peer-reviewed journal article. While it’s uncertain which catalyst will send the stock into overdrive it’s abundantly clear this is one of the most undervalued stocks in OTC.

Pound-for-Pound Comparison of Paxlovid and PLM

Paxlovid also helped lower the length of time people with underlying medical conditions were infectious. However, Paxlovid is not a very effective drug and is walking a tightrope with respect to its approval as more and more real-world data reveals their toxicity.

Here is a chart capture from the company’s latest scientific webinar that shows a side-by-side comparison for illustrative purposes. The charts show that Paxlovid can barely turn 30% of the patients PCR negative by day 20 whereas a majority of the PLM patients were PCR negative on day 3. This is an absolute game-changer in controlling the pandemic. The other thing that this peer-reviewed journal highlighted is that the symptoms were eliminated and without those symptoms, people were unlikely to develop Long COVID. It’s very reasonable to believe that PLM stops Long COVID due to its mechanism of action as well as the fact that it appeared to eliminate symptoms in this trial, as seen in the picture below. While it’s nice that Paxlovid stops hospitalization and death, PLM takes it to a new level by making you feel better faster and eliminating the risk of Long COVID.

Investment Summary

Bioxytran is not only sitting on a solution for COVID and a possible end to the pandemic, but it appears they can also treat Long COVID and a number of viruses. All this information is out there in the public domain and investors seem to be sitting on their hands waiting for something more to happen. It’s unclear what that trigger will be. Will it be a video interview on major media? Will it be the IND announcement from the FDA? Or will it be an explosion of XBB1.16 cases in India whereby they fast-track the PLM development in the country? Whatever the catalyst, the risk/ reward scenario on BIXT is one of the best in all of the OTC. The small float coupled with the lack of an S-1 on file eliminating the risk of immediate dilution bodes well for either a long-term or medium-term investor.

Investors need to ask themselves if they could have invested in penicillin knowing the impact it was going to have last century would they have dived in? Investors are facing a similar scenario with PLM. This is perhaps the biggest antiviral discovery of the century which amounts to a functional cure for COVID and possibly other viruses. Will investors stay on the sideline because some grumpy shareholder is selling not allowing immediate price discovery or will they step up to secure their place in history? Time will tell, but what is certain is that PLM will save an immeasurable amount of lives and take away untold suffering if it can navigate its way to regulatory approval. But while BIXT may be curing Covid, there is still only one cure for FOMO. Investors would do well to stop waiting on the sidelines to enter or affirm their positions before this game-changing anti-viral goes viral.

Disclosure: MicroCap Daily and its owners do not have a position in the stocks posted and have posted this article for free without editorial input. This article was written by a guest contributor and solely reflects his opinions.

stocks

Frontera Group Inc (OTCMKTS: FRTG) Breakout as Co Commences Commercial Sales of Immersient Following IntelliMedia Networks IP Acquisition

Published

2 years agoon

August 26, 2022By

Boe Rimes

Frontera Group Inc (OTCMKTS: FRTG) is making an explosive move northbound in recent trading and is currently under heavy accumulation but still unnoticed by most investors. This is changing quickly as some heavy hitters have jumped on FRTG. The Company is only trading for a $2.7 total valuation with a float of just 3,280,000 FRTG is an SEC filer looking to uplist to OTCQB with a 10k coming out any day. From current levels FRTG has a lot of room to grow. Recently Frontera signed a marketing agreement with Long Side Ventures LLC, following an earlier marketing agreement with Stephen Steen on April 27, 2022.

Earlier this year FRTG acquired intellectual property rights from Intellimiedia Networks, Inc., for $5 million in cash and 20 million shares of FRTG. According to the 8k FRTG plans to raise $12 million by year end 2023. Essentially, Intellimedia turned over its assets and Intellectual Properties to Frontera, as Frontera has the platform in place to maximize the value of the purchased IP. Intellimedia Networks is a US and India-based technology company that designs and deploys cloud platforms and applications that create immersive experiences. Intellimedia’s award-winning products utilize AR, VR, and AI to enhance media, training, education, virtual event broadcasting, real estate, and other applications. Frontera brought on business execs Teodros Gessesse and Darshan Sedani.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Frontera Group Inc (OTCMKTS: FRTG) is a strategic acquirer of intellectual property and revenue-generating companies in the technology and human capital markets. It is developing and executing an aggressive, four-tier acquisition and implementation strategy intended to provide substantial increases in profitability to its acquisitions in industries which possess traditionally low and stagnant EBITDA multiples. The Company has identified and is currently pursuing several revenue-generating acquisition targets.

Frontera Group Inc (OTCMKTS: FRTG) is a strategic acquirer of intellectual property and revenue-generating companies in the technology and human capital markets. It is developing and executing an aggressive, four-tier acquisition and implementation strategy intended to provide substantial increases in profitability to its acquisitions in industries which possess traditionally low and stagnant EBITDA multiples. The Company has identified and is currently pursuing several revenue-generating acquisition targets.

Earlier this year FRTG acquired intellectual property rights from Intellimiedia Networks, Inc., for $5 million in cash and 20 million shares of FRTG. According to the 8k FRTG plans to raise $12 million by year end 2023. Essentially, Intellimedia turned over its assets and Intellectual Properties to Frontera, as Frontera has the platform in place to maximize the value of the purchased IP. Intellimedia Networks is a US and India-based technology company that designs and deploys cloud platforms and applications that create immersive experiences. Intellimedia’s award-winning products utilize AR, VR, and AI to enhance media, training, education, virtual event broadcasting, real estate, and other applications.

In connection with the acquisition Teodros Gessesse was appointed as the Chief Marketing Officer of the Company. Mr. Gessesse’s initial annual base salary will be $150,000. Mr. Gessesse will be eligible to receive a quarterly bonus as determined by, and within the sole discretion of, the BOD and was granted 23,500,000 shares of FRTG. Also, Darshan Sedani was appointed as the Chief Visionary Officer of the Company. Mr. Sedani’s initial annual base salary will be $150,000. Mr. Sedani will be eligible to receive a quarterly bonus as determined by, and within the sole discretion of, the BOD and was granted 31,500,000 shares of FRTG. The deal closed on August 17.

$FRTG Our primary objective: To deliver substantial increases in profitability to our acquisitions in mature industries which possess traditionally low and stagnant EBITDA multiples. pic.twitter.com/eTZ6MoHOmE

— FRTGtech (@FRTGtech) August 26, 2022

To Find out the inside Scoop on FRTG Subscribe to Microcapdaily.com Right Now by entering your Email in the box below

In June FRTG released the 3.0 version of its Mixie Holoport immersive reality framework with Extended Reality (XR) support (“Mixie Holoport XR”). Mixie Holoport XR is a National Association of Broadcasters (NAB) Product of the Year award winner, setting the benchmark for immersive realism in Augmented Reality (AR), Mixed Reality (MR), and Virtual Reality (VR) applications. Frontera recently acquired the Mixie Holoport IP to enhance Metaverse business applications.

Frontera also launched its Mixie AI 2.0 powered live video broadcasting solution that will be targeting automated broadcasting applications. Frontera’s recent acquisition of Intellimedia’s Mixie suite of solutions has provided Frontera with a cutting-edge mix of media technology, learning and training platforms, and event broadcasting technologies that position the company at the technology forefront of a new wave of immersive and engaging technologies that continue to redefine applications. Intellimedia’s Mixie AI 2.0 solutions were utilized for Cricket AI Tata Open Tournament and the ISSF Shooting World Championship to simplify and automate the capture, analysis, discovery, and broadcast of both events. The resulting professional broadcast quality and dramatic cost reduction have become a wake-up call for both organizations to stage and broadcast future events.

Earlier this month FRTG reported it has commenced commercial sales and marketing efforts of Immersient, the intellectual property which was acquired from IntelliMedia Networks, Inc. and formerly sold under the Mixie brand name. Now sold and marketed under the Immersient brand, Frontera’s cloud media platform connects content producers, educational institutions, and event producers with participants and viewers, delivering immersive, personal experiences, interactive participation, existing device compatibility, familiar user conventions, and reliable, “always available” service. The Immersient cloud media platform allows its clients to focus on their core businesses, knowing their end users are enjoying state-of-the-art experiences. With its frictionless device and network independent approach to immersive virtual, augmented, and mixed reality environments, Immersient delivers next-generation group collaboration and communications, interactive distance learning and training, and virtualized events, meetings, expos, conferences, and trade shows.

$FRTG ⛱ pic.twitter.com/dHoX6B1NCG

— Mako Warren (@mako_warren) August 26, 2022

For More on FRTG Subscribe Right Now!

Currently trading at a $2,7 million market valuation FRTG has 55,563,482 shares outstanding and just 3,280,000 shares in the float. The Company has a clean balance sheet and recently filed a 10Q with a 10k on the way and looking to uplist to OTCQB. FRTG is an exciting story developing in small caps; earlier this year FRTG acquired intellectual property rights from Intellimiedia Networks, Inc., for $5 million in cash and 20 million shares of FRTG. According to the 8k FRTG plans to raise $12 million by year end 2023. Essentially, Intellimedia turned over its assets and Intellectual Properties to Frontera, as Frontera has the platform in place to maximize the value of the purchased IP. Earlier this month FRTG reported it has commenced commercial sales and marketing efforts of Immersient, the intellectual property which was acquired from IntelliMedia Networks, Inc. and formerly sold under the Mixie brand name. Now sold and marketed under the Immersient brand, Frontera’s cloud media platform connects content producers, educational institutions, and event producers with participants and viewers, delivering immersive, personal experiences, interactive participation, existing device compatibility, familiar user conventions, and reliable, “always available” service. The stock is currently under heavy accumulation, with big momentum, a little float and some well-known investors jumping on board. We will be updating on FRTG when more details emerge so make sure you are subscribed to Microcapdaily so you know what’s going on with FRTG.

Subscribe to Our 100% Free Penny Stock Newsletter. We Have Something Big Coming!

Disclosure: we hold no position in FRTG either long or short and we have not been compensated for this article.

Recent Posts

Clean Vision Corp (OTC: CLNV): Overcoming the Plastic Waste Crisis

Meta Materials (NASDAQ: MMAT): More Due Diligence and Exploring Latest Developments

Integrated Cannabis Solutions’ (OTC: IGPK) 633% Surge: Exploring Catalysts, Company Overview, and Growth Potential in 2024

Sonoma Pharmaceuticals (NASDAQ: SNOA): Potential Surge to Speculations – What Lies Ahead?

1847 Holdings (NYSE: EFSH) Soars: Insights, Acquisitions, and What Lies Ahead

Trending

-

Uncategorized1 year ago

Uncategorized1 year agoMeta Materials Inc (OTCMKTS: MMTLP) Enormous Short Position in Trouble as Next Bridge Hydrocarbons Set to Stop Trading (George Palikaras & John Brda on Corporate Action)

-

Micro Cap Insider3 years ago

Micro Cap Insider3 years agoMedium (KOK PLAY) The Parabolic Rise of Metal Arts (OTCMKTS: MTRT)

-

Media & Technology3 years ago

Media & Technology3 years agoHealthier Choices Management Corp. (OTCMKTS: HCMC) Powerful Comeback Brewing as PMI Patent Infringement Lawsuit Moves Forward

-

Media & Technology3 years ago

AMECA Mining RM; the Rise of Southcorp Capital, Inc. (OTCMKTS: STHC)

-

Media & Technology3 years ago

Media & Technology3 years agoSNPW (Sun Pacific Holding Corp) Power Brewing: 50MW solar farm project in Durango Mexico MOU with Atlas Medrecycler 48,000 SF New Partnership Queensland Australia Solar Farm.

-

BioPharma2 years ago

BioPharma2 years agoAsia Broadband (OTCMKTS: AABB) On the Move Northbound Since Sub $0.08 Dip as Crypto Innovator Elevates AABB Crypto Exchange & Enters the NFT Space

-

Uncategorized1 year ago

Uncategorized1 year agoMeta Materials Inc (OTCMKTS: MMTLP) Short Squeeze S-1a4 Filing Signals S1 Approval Could Be Days Away (Next Bridge Hydrocarbons Spin-Off)

-

BioPharma2 years ago

BioPharma2 years agoHumbl Inc (OTCMKTS: HMBL) Major Reversal as Powerful Advisor Rejoins the Team & Looks to Uplist to Major Exchange

Phil

July 7, 2015 at 4:46 pm

really enjoyed your article. I can tell you know more about LQMT then just trying to bump up the stock for a quick 6% gain.

I cant wait till Apple uses this in a product. the stock will go above $3+, maybe even 5. long term this stock could be at $20 in the next 7 yrs.

WaF

July 14, 2015 at 6:14 pm

If Apple uses this material price will jump more than that…..

If they can get the DoD to use LQMT in the canards of the missiles that will be a boon as well.

There is little reason this company can’t get back into the 20 dollar price range and more.

They just have some hurdles to get over and those hurdles are not product related.

LQMT is an exceptional alloy.